Bookkeeping is the ongoing recording of the financial transactions conducted by a business or other organisation. This includes purchases and sales and all forms of expenditure and income.

Traditionally, these records were kept in physical books called account books, hence the name book-keeping.

With the growth of computer technology, software, databases and remote data storage facilities, financial records have increasingly been kept in time-saving and convenient digital media formats.

Whether your financial records are kept in hard copy books or in electronic data form, there is a limited number of standard systems governing the manner in which they are organised and presented.

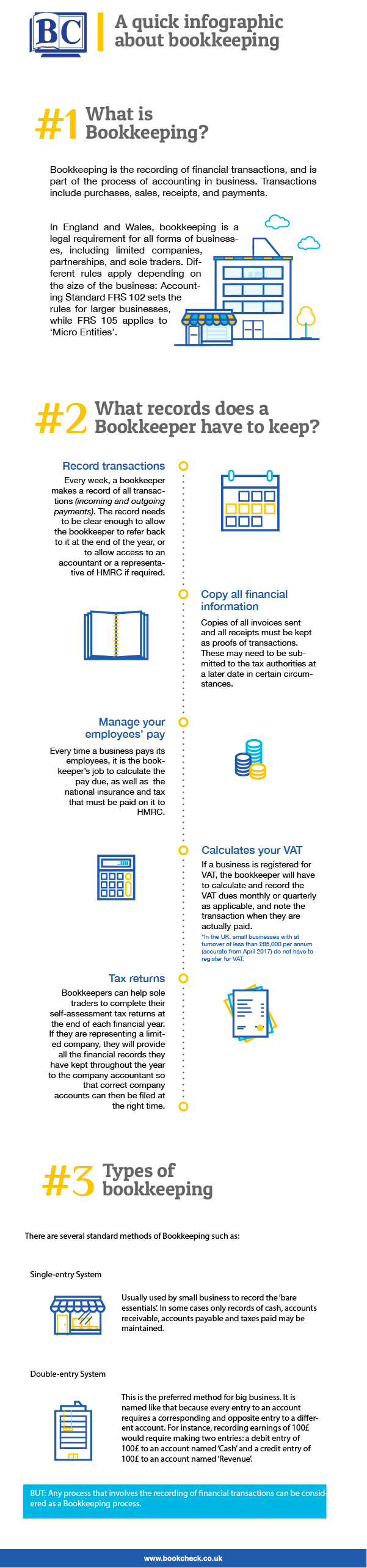

In practice, one of two systems is generally adhered to. These are known as single-entry book-keeping and double-entry book keeping.

Single-entry book-keeping

The simpler and quicker book-keeping system to operate and maintain, this essentially involves a running chronological record of receipts and payments made.

Single-entry book-keeping is ideally suited to sole traders and other small businesses for whom double-entry book-keeping would be too complex and time-consuming to be justified for the additional information it provides.

Double-entry book-keeping

In this system, the financial transactions and assets of a business are distributed among numerous accounts, each of which may be represented by a name or numeric code. For every transaction recorded, a credit to one account is matched with a debit of the same amount to another. Thus, every transaction is recorded in two accounts i.e. double-entry.

The advantages of this system are chiefly twofold. Firstly, by breaking down the affairs of the company into many accounts, it provides a basis for detailed and precise aggregated management information and controls. Secondly, the balancing of credit and debit across two accounts for every transaction allows for controls to be conducted to identify errors.

Training in double-entry book-keeping is needed to understand which accounts to debit and which to credit for each type of transaction - this is a job that business owners do not often find straight-forward, or cost-effective to undertake themselves. Those choosing to use double-entry book-keeping often prefer to outsource the job to dedicated professionals.

Double-entry book-keeping is a tried and tested system. It has been in widespread use on the European continent since the Middle Ages, and was popularised in England in the mid 1550s. It’s now a standard around the world.

Book-keeping and the law

The legal requirements and standards for book-keeping vary under different national jurisdictions. In the UK, until the Companies Acts of 1981 and 1985 implemented a number of EU directives on accounting practices, no legal stipulations had been set for book-keeping; and the UK remains one of the less prescriptive countries in Europe today, allowing a free choice of single-entry and double-entry systems for businesses of all sizes.

Other European countries regulate book-keeping standards much more closely. For instance, in Germany, double-entry bookkeeping is compulsory for businesses whose turnover or profit exceeds a certain threshold; while in Sweden, it is compulsory for all businesses (including sole traders), irrespective of turnover.

The European Union has developed a common set of International Financial Reporting Standards (IFRS). However, its implementation is mandatory only in some EU states e.g. Germany and then typically only for stock exchange listed companies. Other standards such as the Plan Comptable Général (PCG) in France may alternatively be used in some countries.

Under most jurisdictions, it is required to keep not only accounts, but also physical proofs of every transaction (printed receipts, invoices, etc.), so that in the event of disputes with or inspections by the tax authorities, a company can provide evidence that the transaction took place.

When you are exporting goods or services overseas or importing them from abroad, because of the complexity of VAT law and other applicable regulations, it may be necessary to supply proofs of the destination and source countries of goods and services for which you are accounting in your bookkeeping.

Whether you are a sole trader or a company, it is an EU and HMRC requirement to retain all your book-keeping records and proofs of transactions for inspection for six years. This applies even if you have ceased trading.

Book-keeping and VAT

In the UK, all businesses with an annual turnover of £85,000 or more are obliged to register for VAT; for smaller businesses, VAT registration is optional. Most other European countries enforce much lower thresholds for VAT registration, with some making it compulsory for all businesses, including sole traders, no matter how low the turnover.

If you are registered for VAT, you must account for it in your book-keeping, clearly showing the VAT component of all payments made and received. VAT rates on goods and services purchased and sold in the UK are currently 20% except for certain classes of goods that are zero-rated or rated at 5%.

VAT must be charged not only on your sales within the UK, but also on all export sales within the EU. Sales to non-EU countries are exempt from VAT.

Because VAT rates vary considerably both within Europe and around the world, businesses trading internationally after Brexit will find the process of accounting and book-keeping for VAT much more complicated. The VAT rate in force in the country where the transaction is deemed to have taken place will generally apply; but if you are trading with another VAT-registered business elsewhere in the EU, the process of VAT collection and accounting, and therefore also book-keeping, will differ from the one that applies if you are trading with consumers or non-VAT-registered businesses.

If your turnover of sales to specific export markets within the EU exceeds the VAT threshold set by those EU countries’ national governments, you will have to register separately for VAT in the EU destination country and conduct your book-keeping for all your exports to that country on the basis of accounting for your VAT dues to the national tax office of that country.

Profit and loss accounts

At the end of each financial year, all UK businesses, from sole traders to limited companies are required to submit to HMRC annual trading accounts showing an operating profit or loss. This is the province of accountants but small businesses and sole traders may choose to submit their own annual return. These annual accounts will be based on the records of transactions kept by the book-keeper through the year. In the event of a dispute with HMRC over the correctness of the annual return, you may have to have your account books and proofs of transactions ready for inspection.

Contact BookCheck for Professional Book-keeping

Need professional help with your book-keeping?

Call BookCheck today on 0800 883 0711 or email [email protected], and find out how our dedicated team can help you and your business.